Mr. Biden's Very Bad Capital Gains Tax

The Democrats War on Wealth Continues

It's an election year, and once again, President Biden and his Democratic cohort resume their typical liberal campaign—promising that all their expansive government spending programs, which purportedly will cure all societal ills, can be funded by just tax on the ‘rich’ who need to “pay their fair share.” Recently, Mr. Biden unveiled a slew of disastrous tax proposals in his 2025 budget, provisions of which will assuredly materialize should he secure reelection.

Conventional political wisdom points to Mike Johnson relinquishing the Speaker's gavel to Hakeem Jeffries, with the GOP likely to lose control of the House. Meanwhile, although the Senate map is ostensibly favorable for the Republicans, it promises no guaranteed victories beyond West Virginia; thus, should Mr. Biden triumph, he would face a slim Democratic majority in the House and a 50/50 Senate— the same scenario as in 2021. Recall the chaos Mr. Biden wrought under those same conditions. With almost all of the individual provisions of Donald Trump’s 2017 tax cuts set to expire in 2025, a second term would be the perfect time for Mr. Biden to enact tax hikes.

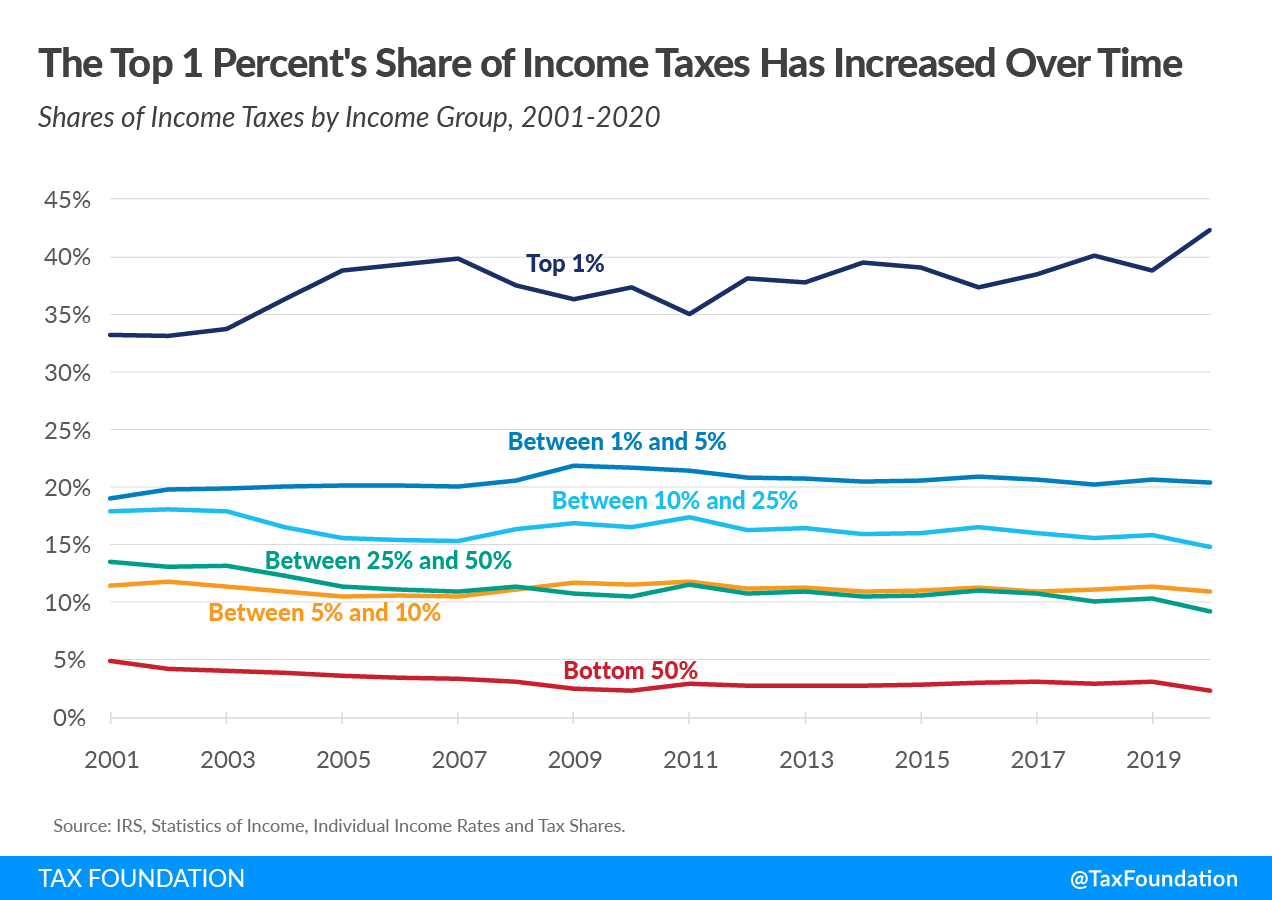

Mr. Biden, in an op-ed for the New York Times, wrote that his solution to paying for his gargantuan budget is to compel the highest echelon of American earners to ‘pay their fair share.’ Of course, the 1 percent of wealthiest Americans already pay their ‘fair share,’ paying roughly 49 percent of all Federal income taxes. However, in fairness to our Democratic friends, facts—especially those related to fiscal policy—often remain elusive and a source of annoyance. Al Sharpton, formerly a perennial candidate for Senate, Mayor, and President and MSNBC host, once adamantly insisted in an interview that “[the] top one percent in this country pays very much less than 10 percent [of income tax].”

According to the Tax Foundation, the 10 percent pay two-thirds of the income tax, while the bottom 50 percent—all Americans with an income below the median of $74,580—pay roughly three percent. No other nation depends on the rich to foot the bill like the United States. But Democrats have an itching desire to spend as much of other people's money as they can, and one suspects they fall asleep with giddy dreams of confiscating as much property as possible. Of course, when the progressive political coalition seems to stem from a burning desire to redistribute wealth and feed the resentment some may have for the rich, the result is as follows.

Mr. Biden wants to raise the capital gains tax to 44.6 percent, which, combined with state capital gains taxes in my home state, the Commonwealth of Pennsylvania, sitting at 3.07 percent, would lead to a combined rate of 47.67. Residents of other states are less fortunate; their rates would exceed fifty percent. California’s combined rate would be 59 percent, New Jersey's 55.3 percent, Minnesota's 53.4 percent, and New York's 53.4 percent.

As if that weren't bad enough, capital gains are not indexed to inflation, meaning you could pay taxes on gains that are effectively worth less if inflation rises. This is why capital gains currently receive a preferential rate; the maximum tax rate presently for long-term capital gains is 23.8 percent—to mitigate the impact of inflation. Anyone who sells an asset could face a 44.6 percent tax rate, and likely, the gain being taxed is not real, considering that inflation has driven overall prices up by 19.4 percent since Mr. Biden assumed office.

Economic growth does not stem from government spending, despite the assertions of liberals and fervent Keynesians. Instead, it arises from investment, which drives productivity. Capital investment enables businesses to provide their workers with means to increase productivity, thereby boosting wages and tax revenues. Taxing capital gains will likely lead to less investment, slower growth, and a wage decline. Coupled with Mr. Biden's stagflation and rising energy and utility costs, this would be disastrous for Americans.

Mr. Biden's newest tax idea is even more ludicrous. It seems fitting that Democrats, insistent on spending money the country doesn't have, wish to tax income that the American taxpayer doesn't have. Mr. Biden's 'unrealized gains tax' is essentially a way of saying that the government is targeting wealth that exists only in the realm of potential—wealth that has yet to exist. Consider a hypothetical scenario where a house, the largest asset most Americans possess, appreciates from $516,000 at a rate of 6.4% to about $549,627. Under an unrealized gains tax, and at Mr. Biden's proposed capital gains rate, the homeowner would be liable for taxes on this $33,264 gain at a rate of 44.6%, amounting to nearly $14,846—all without having sold the property or realized any cash from this appreciation.

The Democrats who authored this "prepayment on future capital gains" insist that it will only affect 'billionaires' pitching it as targeting roughly 700 American taxpayers. Besides the unconstitutionality of such an action, Article I, section 9 specifies, “no Capitation, or other direct, Tax shall be laid, unless in Proportion to the Census or enumeration herein before directed to be taken” government confiscation of property, always a heinous idea, never affects only billionaires. Every tax, no matter how big or small, ultimately impacts the middle class.

The AMT, passed in 1978 under President Jimmy Carter, was defended with claims that it would target only 150 of the wealthiest Americans; yet by the time it was repealed in 2017, it affected five million taxpayers. Similarly, the first income tax was applied only to income that, when adjusted for inflation, would be equivalent to eighty-five thousand dollars today, at rates ranging from 1-7 percent. As the Biden administration and future administrations continue to spend, there will be no end to the Democratic demand for money, leading the tax to be applied to more and more people.

It is also worth noting that besides disincentivizing investment by potentially doubling the capital gains tax, investors will react by risking less capital on new ventures or expanding existing ones. Why would they do so if more than half their earnings would be taken away? This would hardly be a tax only on the wealthy; this tax increase affects anyone with a 401(k), an IRA, or a college savings plan invested in the stock market.

Most Americans do not realize that they are investors and holders of capital with their 401(k), IRA, or other accounts they contribute to. Such a tax would hinder the growth of these accounts, which rely on a healthy stock market and favorable tax environment. The most cruel aspect of this tax is the impact it would have on families saving for education through 529 plans, which are designed to use the stock market’s potential to outpace tuition inflation; an increase in the capital gains tax would compromise this strategy and place higher education out of further reach for American families, lest they wish to take on six figures of debt.

Furthermore, this would position the United States as the most hostile country globally for business and investment. The proposed rate of 44.6 percent, would make our capital gains tax the highest in the world, surpassing Denmark, which currently levies the highest capital gains tax at 42 percent. The United States would quickly become the least attractive destination for both domestic and foreign investment. Capital is mobile and disregards borders; if we make it costly for capital to achieve returns here, it will find a home elsewhere, taking jobs and growth with it.

Nor would it raise any money to pay off our debt or meet our spending obligations, mandatory or otherwise. The Laffer Curve demonstrates that beyond a certain point, higher tax rates actually reduce total tax revenue by decreasing the amount of taxable income. This, combined with the loss of jobs, results in a decline in taxable income and payroll tax contributions. Additionally, investors would hold onto assets longer to avoid realizing taxable gains, further depleting our revenue and exacerbating our national debt.

Would we not want pro-growth policies to warm the investment climate in this bleak economy, resulting in capital flowing into technology, manufacturing, and housing - industries that create jobs and result in a strong economy? In fact, besides investors withdrawing from the market due to diminished returns, which would result in reduced capital for companies to expand and innovate, we would see Americans face the unmentioned psychological aspect. High tax discourages individuals from investing in the market, and we would see less participation in 401(k)s or IRA, leading to either less productive ways of saving for retirement or an increase of people reliant on strained programs, such as Social Security.

This tax would be the most destructive ever passed in the history of the United States. It would likely precipitate a financial crisis by stifling investment, killing growth, and harming every American citizen. It must never pass. Whether you plan to vote for Mr. Biden or Mr. Trump, know that all tax proposals ultimately must stem from the House of Representatives - a Democratic majority would be eager to go along with this. A Republican majority would never let it see the light of day.

Keep that in mind when you vote in November.