The Travesty of Tariffs

Where both Biden and Trump get it wrong on trade

Our polarized landscape is peppered with leaders who wax lyrical about advocating for the “common man,” yet their trade policies leave the same folks out hung to dry. Donald Trump, who otherwise speaks and acts logically on taxation and deregulation, is guilty of singing such a siren song, finding himself in a similar trade position as Bernie Sanders, of all people. Their populism, allegedly done for the sake of the everyday Jane and Joe, marries worst excesses of the left and the right into a nightmarish family reunion that nobody asked for, fostering a climate where a storm of ignorance clouds the overwhelming benefits of free trade.

Free trade has been attacked for the last thirty years or so. It has been blamed for losing manufacturing jobs and derided for opening American markets to foreign competition. Of course, this incorrect thinking ignores the law of comparative advantage and specialization, where countries excel at producing certain goods more efficiently than others; rather than attempting to be 'best in everything,'’ it allows nations to trade their strength for the strengths of others. Even if a country can produce everything more efficiently than another, which the United States could, it's abundantly clear that nations benefit if they specialize in what they produce most efficiently and trade their productions in global markets. Think of an orchestra where multiple musicians play the instrument they are best at, creating a better harmonious sound.

The North American Free Trade Agreement (NAFTA), formed in 1994 between the United States, Canada, and Mexico, focused explicitly on eliminating remaining barriers between the U.S. and Mexico. The three NAFTA members are economic powerhouses operating as producers, consumers, and significant agricultural players. NAFTA is a prime example of a trade deal in which every party has emerged victorious. Your breakfast smoothie typically hinges on the volatile whims of climate—NAFTA is the reason, with its reduced tariffs and open borders, that your grocery aisle is filled year-round with oranges from Florida, avocados from Mexico, and apples from Canada without a nightmarish price spike at the checkout counter. This trade liberalization has enhanced the diversity of produce available and stabilized prices; it is impossible to argue that this is anything but overwhelmingly beneficial.

This is all the more reason why it is absurd to believe free trade has ‘hollowed out’ our country. There is a prevailing notion, held primarily on the left but increasingly on the right, that free trade and unchecked capitalism have led to the erosion of our standard of living and that the only remedy is bigger government, increased regulation, and tariffs that both punish and reduce Americans' economic freedom.

Frequently, protectionists defend their beliefs as “fair trade,” though when pressed to explain what fair trade is, they freeze like deer in headlights. One complaint is that labor, particularly in Asia, is far cheaper than labor in the United States—therefore, we must impose tariffs. Economic freedom and liberalization are how the United States and the Western world defeated the Soviet Union; the communists could not sustain a system that fostered a low standard of living, a lack of basic goods, and little trade with the outside world. Thus, free trade is the only form of fair trade—the most equitable. Competition with Chinese manufacturing incentivizes U.S. producers to innovate and harness new technologies to reduce costs, creating new opportunities for employment and economic growth and forcing a pivot to areas where we hold a competitive advantage. In this scenario, the real winner is not necessarily China or the United States—it remains the consumer, who is served simultaneously the cheapest and best goods.

The Washington Post broke the news that Donald Trump, who proudly refers to himself as “tariff man”, plans to downgrade China’s trade status with the United States in a potential second term, resulting in skyrocketing tariffs and revoking their “most favored nation” status. That action would result in additional tariffs of up to 40 percent, on top of his plan to introduce an across-the-board tariff of 10 percent applied to any imports as the new “price of admission” to the American market. Such fixation on China remains questionable, particularly considering how China’s share of U.S. goods imports has fallen year after year and is the lowest since 2006.

Make no mistake—tariffs are disastrous. They raise prices for goods, whether domestically or imported, and also tax imports. In 1930, Republicans in Congress passed the Smoot–Hawley Tariff Act, which raised tariffs on over 20,000 imported goods, based on the erroneous belief that such a measure would restore jobs and prosperity lost during the Great Depression. The result was a series of retaliatory tariffs, particularly by the Dominion of Canada, which resulted in a de facto end to global trade. America, Europe, and Asia remained cut off from export markets; American exports and imports declined by 67 percent, dramatically impacting the manufacturing industry, which did nothing but exacerbate the unemployment loss and lack of capital during the Depression.

It makes intuitive sense that imposing a tax on imports would lower the overall quantity of imports and, therefore, help the trade deficit; however, that’s not how the trade deficit functions. The amount of net exports is always determined by the difference between saving and investment in an economy, which is determined exogenously by domestic interest rates and consumer expectations. Imposing a tax on imports does nothing but raise the real exchange rate, as a reduction in imports means that the difference between exports and imports will be higher for any given exchange rate. In reality, because this value is determined exogenously, it simply means that the real exchange rate—or the price of the American dollar—increases. Consequently, the policy stimulates imports in a way opposite to how the tariffs suppress them, eliminating any positive impact on the trade deficit. It can also be argued that the trade deficit is good—signaling that we can afford to consume more than we produce.

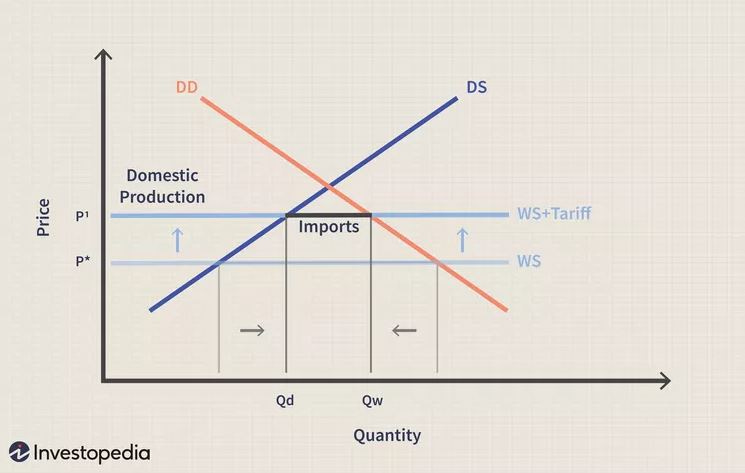

The graph depicted above illustrates the effects of free trade on worldwide markets. Two threads—DS, representing domestic supply, and DD, the domestic demand—entwine. In our domestic marketplace, the price of goods naturally settles at P. Yet, beyond the shores, the world stage offers these goods at a more tempting price, marked as P*. Lower world price incentivizes domestic consumers to consume Qw's goods eagerly. Still, domestically, we can only muster Qd units of production—leaving us with quite a wide gap, the Qw-Qd, which we fill with imports.

If trade is a highway—tariffs are the tollbooth. When tariffs are introduced, prices are raised from the global harmony of P* to P', resulting in domestic producers expanding their output, nudging Qd rightward. But, even as domestic production swells, the allure of imported goods wanes from inflated costs, resulting in Qw shifting leftward.

Tariffs are nothing but taxes. As Ronald Reagan elaborated in 1979, “Business is not a taxpayer; it is a tax collector. Business has to pass its tax burden on to the customer as part of the cost of doing business.” Tariffs increase the price of goods and services in domestic markets by applying a tax on imported goods paid by the domestic importer. Not to mention that the protection of domestic industries comes at the cost of consumer ease and global trade fluidity, leading to a vicious cycle of retaliation.

Tariffs' authoritarian nature and the lack of respect for the free market are more concerning. Trump’s former senior advisor, Stephen Miller, defended Trump's trade policy by denouncing free trade as “a false religion that melts minds” and boldly declaring that “a tariff is not a tax on 'every American.’ A tariff is a tax assessed on foreign goods made by foreign labor. Under a tariff system, if you make it here and build it here, you pay no tax.”

Mr. Miller overlooks a critical truth that everyday American consumers, business owners, and farmers feel that when a tariff is imposed, China does not pay for it but by American importers who pass it onto the consumer. Thus, many Americans prefer and seek out these foreign-made products, and their choice to purchase globally is a valid expression of consumer freedom. The government should not force economic nationalism that seeks to undermine their freedom and hike costs across the board. Among economists, this isn't a contentious point—it's understood. Ignoring this is either to reject basic economic principles often taught in an AP high school course or to disregard logic for political gain.

The Trump administration began its trade war on China by imposing tariffs of 25 percent on imports—such as luggage, bicycles, televisions, solar panels, steel and aluminum, and washing machines. China and other nations retaliated with tariffs on U.S. agricultural exports. U.S. exports to China, particularly soybeans and pork, were heavily taxed—with rates from 2.5 to 25 percent. The results were catastrophic, with a reduction in agricultural exports of $27 billion from mid-2018 to 2019, specifically in Iowa, Illinois, and Kansas, where GDP losses alone amounted to $3.8 billion.

Rather than allowing the flow of commerce, Mr. Trump decided to authorize $23 billion in bailouts to the agricultural industry in 2018 and 2019—his means of offsetting the harmful damages. The Soviet Union would be proud of such central planning, and it was absurd that Mr. Trump would handcuff farmers with a ludicrous trade war and irresponsibly throw taxpayer money to solve it. The consequences were dramatic; a January 2021 study by the U.S.-China Business Council concluded that the trade policies cost the United States 245,000 jobs.

The Biden administration remains slightly better on trade, though their lack of an unapologetic commitment to free trade led to the baby formula shortage in 2022. When domestic supply chains were weakened and production was halted during COVID, the demand for baby formula could have been tempered by turning to foreign producers—but our central planners in Washington had different plans for you. FDA labeling regulations and tariffs of 25 percent on a necessity left many mothers panicked and fearful as they stared at empty grocery shelves. It took Congress ages to act and finally lift these tariffs—though only temporarily. The special interests, particularly in the dairy industry, prefer an isolated and fragile dairy market; who cares if your child starves? They have pocketbooks to fill!

The truth is that protectionism is the actual source of economic malaise, discomfort, and a reduced standard of living—not free trade. Donald Trump, his allies, and donors are well insulated from the effects of tariffs, as they reside in Mar-a-Lago or the D.C. Suburbs. Veronique De Rugy, writing for Reason, explained how protectionist policies, tariffs, and subsidies inflate consumer prices, affecting food and clothing—which hurt the poorest Americans the most, as they spend a higher portion of income on basic needs. She correctly insinuates that tariffs are a "luxury belief" espoused by privileged individuals that signal virtue but serve detrimentally to the less fortunate and worsen the plight of those they are supposedly designed to protect.

The Trump tariffs are levied through Section 232 of the Trade Expansion Act of 1962; Article I, Section 8 of the Constitution, proclaims that “the Congress shall have the Power to lay and collect Taxes, Duties, Imposts, and Excises.” Still, Section 232 has resulted in Congress abdicating its responsibility to regulate such matters properly. Senator Pat Toomey, who served from 2011 to 2023, was often one of the few voices of reason when it came to trade - and he unsuccessfully attempted to wrestle control of tariff policy back into the hands of Congress.

Repealing Section 232, which is ripe for abuse and has been abused, is an imperative first step in undoing the damage caused by trade. It is critical to America's prosperity this decade for the United States to seek free trade agreements with the United Kingdom, the European Union, and many Asian countries. If we paired ourselves with the UK, Canada, Japan, Mexico, the European Union, Vietnam, the Philippines, Korea, and India, and others—we could eradicate Chinese influence in Asia and force them to come to the negotiating table, resulting in a cessation of the intellectual property theft and currency manipulation they engage in.

The United States’ current trade war with the European Union jeopardizes the long-standing alliance with Europe and hurts domestic industry. The Biden administration cleverly avoided a crisis by allowing European steel and aluminum imports to be exempt from tariffs. This resulted in a conciliatory suspension of the EU's retaliatory tariffs on U.S. products like motorcycles and bourbon whisky. The EU’s suspension only runs until March 31, 2025, after which a 50 percent tariff on American bottles shipped to Europe will kick in. President Biden has met with European Commission President Ursula von der Leyen repeatedly, yet we are no closer to an agreement than last year. It’s another example of a campaign promise Mr. Biden did not keep, having pledged to roll back tariffs and protectionism policies of the Trump Administration, and we’re all worse off for it.

Tariffs may be sold as saviors, though they are heavy chains that burden the poor and benefit the insulated rich. The free market has done more for human flourishing than any government policy. We must embrace free trade in this decade, not run away from it.